Occupational Tax was Arlington's First Financing Method

The following is an article published in a February 1972 special issue of The Citizen Journal, written by Gene Randall.

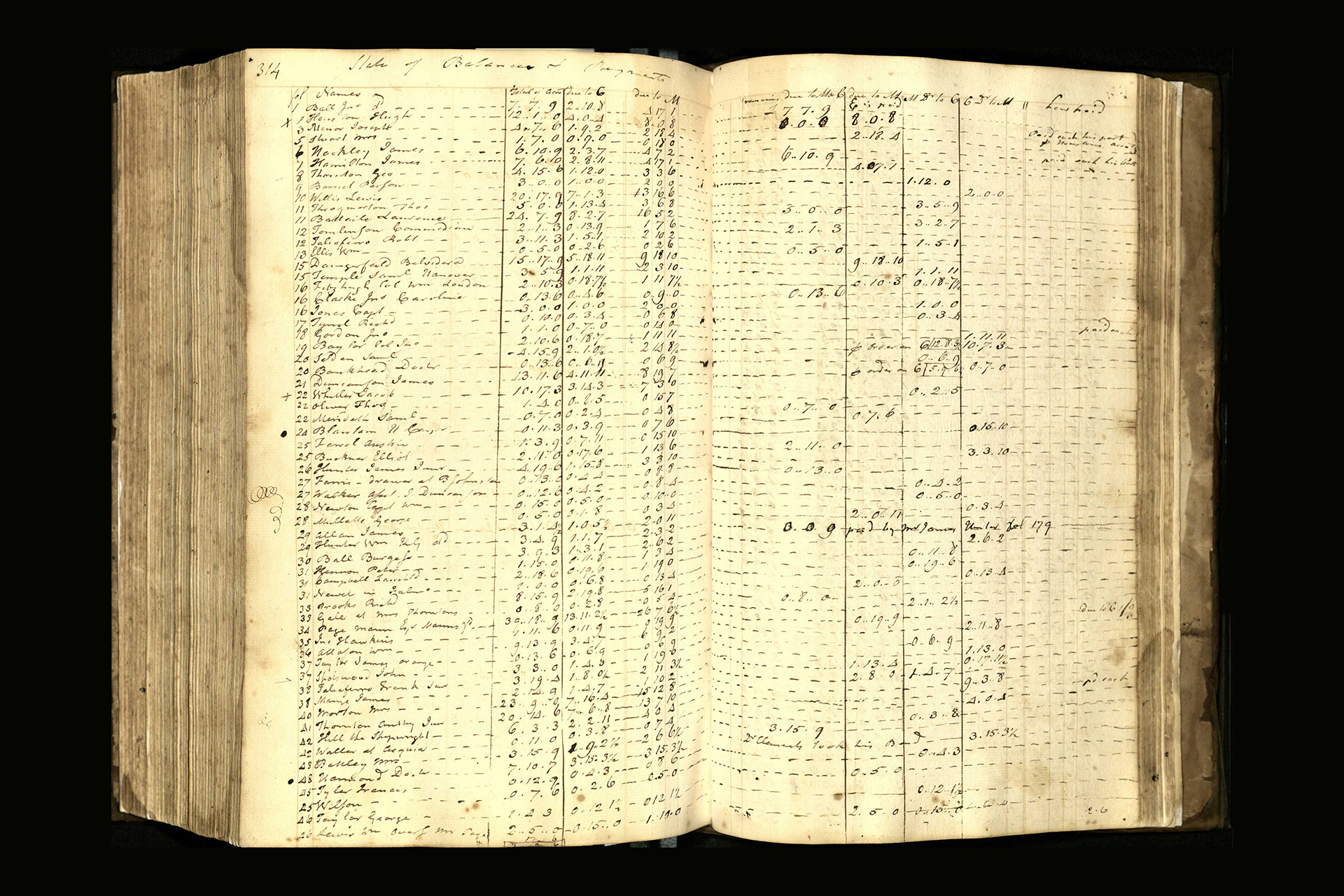

Need of funds for the operation of the city government and methods for paying city officials apparently offered a real challenge to early-day city councilmen, who responded with some imaginative legislation.

Legislators today are considering new forms of taxation, and an occupation tax has been discussed, but Arlington had an occupational tax in 1884— the first method of taxation put on the books.

The tax assessed, on a yearly basis, a fee for every profession, and for almost every vocation imaginable. It is most interesting to note the amount of tax placed on the various jobs.

For example, traveling salesmen and fortune tellers were taxed at $87.50 per year—the highest tax—and whiskey salesmen were charged from $10 to $50. Clairvoyants, land agents, lawyers, dentists, food peddlers, cotton buyers, and grain dealers each paid $2.50 per year.

Anyone who listed the posting of bills and circulars as his occupation paid only $2, and merchants were assessed on a sliding scale from $1.50 to $62.50, depending on their sales volume.

Photographers paid $3 each and photo salesmen were charged 50 cents extra, or $3.50. Also rated at $3.50 were commission salesmen. Auctioneers were assessed $6, sewing machine salesmen paid $7, just 50 cents less than food peddlers with one horse or a pair of oxen. Of course, a food peddler with two horses or two pair of oxen had to pay $15.

Bankers and stock brokers were assessed $8, along with shooting gallery operators. If you owned a pool hall, the charge was $10. (Two years later, the Council outlawed pool halls, so that tax revenue dried up.)

“All persons keeping or using for profit any hobby horse or flying jenny” were assessed $8 and lightening rod salesmen and cotton brokers paid $9.

When it came to show business, the cost went up in many cases. Every circus performance was taxed $25 and acrobatic exhibitions had to pay $5 for each show. Magicians were charged $5 and regular concerts of a cultural nature were charged only $1.

On the paying side of the ledger, as was common in many towns, the Mayor and town Marshal were paid on commission. The Marshal at one time received “all but $225 a year out of the town’s treasury.” Later this was revised to $25 per month salary plus eight percent of all of the town’s ad valorem taxes.

The two town attorney’s received $5 for every guilty verdict and $10 for every not guilty decision, apparently in an effort to ensure that everyone would receive a fair trial. However, the Marshal received most of all fines collected and the mayor received a share of prosecution costs.

The Mayor received varying compensation until 1886. when his compensation was set at $2 per Council meeting plus various fees for criminal cases. These fees included:

- Complaints, 75 cents

- Warrants of arrest, 75 cents

- Bonds, 50 cents

- Subpoena, 25 cents

- Docking cases, 10 cents per person

- Swearing each witness, 10 cents

- Empanelling a jury, 50 cents

- Each judgment, 50 cents

- Each execution, $1